Brown Belt

Brown Belt Social Trading

Introduction

Are you financially independent? Would you like to be?

According to W

It is important to emphasize that an individual who possesses financial independence does’t need to have a high level of income but a high level of free time. It is a term that refers to wealth in time and not wealth in money.

So, if you are an individual trader and want to be financially independent this post is for you. Now, here’s the interesting part.

There are many strategies to achieve financial independence, but all of them need passive incomes. The good news is that social trading is one of the passive incomes weapons at your disposal.

You need passive incomes

Passive income is the income that results from the cash flow received on a regular basis, which requires the recipient to make minimal to no effort to maintain it. Moreover, to achieve financial independence, it will be useful if you have a financial plan, so you know what money comes in and goes out, you have a clear vision of your current incomes and expenses. Thus, you should identify and choose the right strategies to move towards your financial goals. A financial plan addresses all aspects of your finances.

As an example, a source of passive income is the sale of books. Writing a book is something that takes a lot of time, but once published any sale you have does not directly depend on your active work but generates certain money passively.

Social Trading is a passive income

You may be wondering at this point…must I have to write a book?

Not for sure. Nonetheless, you are a trader, so you can make use of the social trading.

But what exactly is social trading?

Social trading is simply the possibility of copying the operations of other traders, thanks to a trading platform. In other words, it offers you the possibility of obtaining free financial advice from international expert traders whose performance you can easily evaluate due to the statistics offered by each user’s broker. Above all, this type of trading involves advantages that are certainly interesting.

Social Trading opportunities

Social trading has some advantages.

We explain them below:

It is easy

The clearest advantage of social trading is that it is easy. By monitoring the activity of other traders, beginner or intermediate-level operators can base their movements on the professional decisions of the most experienced traders. So, there is no need to perform one’s own trading system.

Diversification

It allows diversifying operations in a very efficient way since although it is impossible for a single user to dominate all markets, with social trading, being able to copy other users, you can make a selection of experts in different markets. For example, you could follow a trader who is an expert in commodities, another in currency and another in the US stock market.

Reliable information

Accessibility and Reliability of Information. The platforms which advocates for this kind of trading contain immense quantities of useful and reliable information. Certainly, this information is highly valuable to new traders.

Bonus for good traders

Last but not least. If you are one of these good traders then it is a way to prove your worth to the world of financial investment. In other words, many traders gain prestige in these social investment networks and end up generating good incomes with broker’s commissions operating their own systems.

Sounds good, doesn’t it?

Social Trading dangers

To be honest you must be aware about social trading disadvantages. See below:

Divergence/delay

Delayed signaling. Divergence/slippage can be important with respect to the original trading operation with almost all social trading brokers.

False sense of security

Social trading platforms emphasize that you will do the same operations as the most successful traders in your network, and the implication is that you will earn money. Nonetheless, new traders can forget that everyone loses at times. They could start copying a trader at the beginning of a winning or losing streak with unrealistic expectations of how much money they can earn, and therefore can invest more than they can afford. When they lose that money, they can give up a large portion of capital, while the trader they copied may have lost a much smaller percentage of him or her.

Possible overconfidence

Which consequently can lead to operators not seeing markets in a way they would never do if they were not copied. No trading system is really “set it up and forget it”, but this is exactly what some traders expect to be able to do with social trading. Trade always requires effort. Even if you are copying the trades of a successful trader, there is no guarantee that he or she will continue that long-term success. As a result, you should always be monitoring the traders you are copying. By monitoring your performance in different market conditions, you can refine your strategy and concentrate on copying the traders who perform well in certain market conditions as long as they exist and changing tactics as the market changes.

Trading conditions can differ

New traders may be operating under very different conditions from the traders they copy. When you copy a set of trading patterns in a market, you have no idea of the circumstances of that

Continue learning

In general terms, social trading is a fascinating way to start trading CFD or try trade if you are not sure of the practice. However, you must remember that it is a system that is far from perfect. On the other hand, there is no guarantee that you will make money just because you are copying traders who have historically done so. The best way to trade is invariably to devote time and effort to learn how to develop your own systems, manage your own risk and perform your own operations.

How to Make Money with Social Trading

The main objective to operate with social trading is to generate profits or earn money that otherwise you could not. So, how do you really make money with social trading?

The way to obtain profits with social trading is through the selection of the winning traders. The copy-trading is the same as traditional trading, based on trading systems and has winners and losers. The general intention of social trading is, essentially, to select the traders that will win, since, after all, everything that the selected trader does is automated. Here are some tips on how to make money with social trading:

Tips for Social Trading

Choose the platform with your own methods

Most platforms offer intuitive tools, additional aids, and even monetary incentives. Analyze the available platforms and try to match them in relation to your own styles.

Identify your trading goals

Establish your own investment strategies and trading goals. Seek out which financial markets you’d like to target and for what time periods. Creating a plan in regards to your goals is very important. It will help you refine your trading process. Knowing your own criteria will help you select a trader you’re comfortable in copying.

Filter using the available criteria

Different trading platforms and exchanges have different filtering options. For example, Darwinex lets you filter and identify the best traders to copy in accordance with their own proprietary index. You can also filter according to markets and things such as historical consistency.

Look for consistency and high performance

Identify traders that have shown high performance in their trading returns. High performance can mean luck. Look for investors and traders that are showing consistent records on a statistical basis. A trader that has returned 25% over the course of 400 trades in a year, is a better choice than a trader that has returned 50% over the course of 3 trades in just a week.

Place usual risk controls on your account

Your account when copying traders should be limited. Usual risk control and money management is a must. Putting your entire account in the hands of a single trader is a crazy decision.

Well, what’s the catch? The downside is that you never know for sure on any social trading platform which traders will be 100% correct. In addition, you need to do your own due diligence. Finally, examine your candidates for social trading very carefully.

How to operate with social trading?

To operate taking advantage of social trading, you just have to open an account in a platform that is dedicated to this type of investment and deposit some funds to have cash available for investments.

It is important to select a safe investment broker that does not pose a risk of falling into a fraud or a scam. Above all, you must follow the elementary security checks that every trader should know.

Due Diligence

We recommend that you read the reviews that appear on the following website which have avoided many frauds:

https://www.forexpeacearmy.com/

This site is specialized on Forex brokers but almost all brokers work with Forex.

Select the best ones

You should take a look at the statistics of the traders. Generally, brokers offer a classification, so it is easy to identify traders who are making better profits in recent times. Thus, all you need to do is select which users you want to copy automatically or, if you prefer, just follow them and copy the operations that seem appropriate to you manually.

There’s just one problem, as in any financial instrument, we must bear in mind that to earn money, we must risk it. The golden rule is in place: “Past performance is no guarantee of future results.”

As a general rule, social trading platforms offer their users the possibility of investing in CFDs or Forex, because these are the financial products that, due to their particularities, allow to properly diversify thanks to their leverage.

Social trading brokers

Darwinex

It’s a concept that we love.

Investing in Darwins (a trading strategy nuanced with risk control tools) seems like a very good idea. It is a growing platform, and we love its transparency and its philosophy of aligning the objectives of trader, copytrader, and broker.

Against it, the offer of Darwins to copy is somewhat limited. Its real profitability, discounted the so-called divergence, is low. That makes the Darwins that really worth copying are at most twenty.

In the near future, we could make more detailed articles about this broker. We sincerely believe that in a few years, it will give a lot to talk about and it will be a very interesting option.

There is potential in the future if you become one of the top traders because Darwinex and the Darwinia Index automatically invest in the top traders.

Disclaimer: 71 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to run the high risk of losing your money.

eToro

It is the leader for many reasons.

The main reason is the enormous variety of diversified traders that it offers to copy. Secondly, it provides us with abundant information, the social component and the trader-copytrader contact. Its nice and simple interface is ideal even for those who start in this world.

DISCLAIMER: 66% of retail investor accounts lose money when negotiating CFD with this provider. You should consider whether you can afford to run the high risk of losing your money.

Ayondo

It is a very good platform with a lack of great traders.

Ayondo is a copytrading platform very well mounted on a visual and informational level, but, where it costs to find traders that are worth copying.

It offers a few hundred traders for copies. Barely a ten of the 100 copiers and the truth is that neither the TOP traders (the 10 most copied) have given us very good feelings, with ugly return curves and somehow great drawdowns.

I hope they will be renewed incorporating more and better traders. They could be a good option in the future.

DISCLAIMER: 77.2% of retail investor accounts lose money when trading CFDs and spread bets with this provider. You should consider whether you can afford to take the high risk of losing your money

Zulutrade

Zulutrade is a CopyTrading platform in which there is a huge variety of traders to copy, often with exorbitant returns which clearly means reckless systems. However, the problem here is how difficult it is to find good traders who don’t trade with martingales or any other destructive trading technique.

This is NOT a recommended site for rookies.

Myfxbook AutoTrade

Myfxbook is best known for its statement sharing services and also provides AutoTrade capabilities. That allows traders to benefit from their version of the social trading network. There are a handful of elements that Myfxbook AutoTrade believe sets them apart from the other Forex copy trade networks available.

They constantly monitor their traders and select the best systems for you to choose from. This is an intelligent approach, as I have personally found in the past, that other networks inflate their signal provider numbers by allowing bad traders to be part of the network.

In terms of social trading networks, I would rank Myfxbook AutoTrade in the upper middle because I have seen too many accounts disappear with “great” return curves.

The trading results being provided are all verified, and the platform works smoothly with many different brokerages. This is not a bad option if you are interested in copy trading.

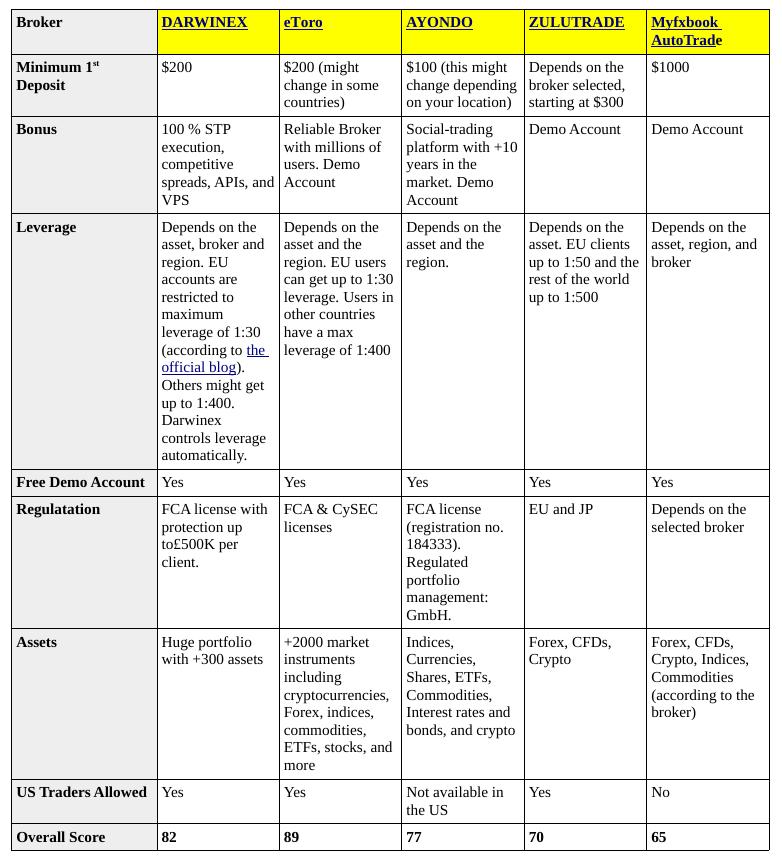

Social Brokers Summary

Below is a compilation of data extracted from the site Social Trading Guru.

Conclusion

You need passive incomes and social trading has the potential to give you pas

Social trading is simply the possibility of copying the operations of other traders, thanks to a trading platform.

Advantages:

- The clearest advantage of social trading is that it is easy for traders.

- It allows diversifying operations in a very efficient way

- Accessibility and Reliability of Information.

- Social trading let you prove your worth to the world of financial investment.

Disadvantages:

- Delayed signaling.

- A False sense of security.

- Possible overconfidence.

- Trading conditions can differ from original trader ones and yours. Remember, all of us know that “Past performance is no guarantee of future results.”

Tips

- Choose the platform with your own methods.

- Identify your trading goals.

- Filter using the available criteria.

- Look for consistency and high performance.

- Place usual risk controls on your account.

If you feel that this is for you, then select a good broker (currently my personal selection is Darwinex) and start developing your social trading system.

Be sure to follow my advice on the scientific trading systems also applicable to social trading.