Brown Belt

Brown Belt Bases of Scientific Trading Systems

Introduction

What is the secret to get a consistent trading systems?

It’s not an easy question to answer.

But you probably know other people that are able to generate incomes from every strategy. Perhaps not in person but on the web. They are very good individual traders.

How do they do it? Do they know some trading system building secret that you don’t?

Actually, yes, they do!

It may happen behind the scenes, but some people know how to get consistent trading systems with ease.

I’m one of those people ?

And today I’m going to show you how: the bases of the scientific trading systems and their design.

The Scientific trading system (STS)

In the trading literature, there are the following terms and some similar ones: Trading strategy, trading system, trading plan, portfolios theory, asset analysis, High-frequency trading, pricing models or algorithmic trading are some of the terms used in trading. They are methods that traders use to determine when to buy and sell assets in the financial markets.

We will call all of them as Trading Systems. A variety of techniques base them. Technical and fundamental analysis, quantitative methods, statistical, mathematical or any combination of factors.

Scientific trading systems are systems based on the application of the scientific method.

But what exactly is a scientific trading system?

“A scientific trading system is an accurate (that is, reliable, consistent and non-arbitrary) representation of the financial market in order to determine when to buy and sell assets that can be repeatedly tested and verified in accordance with the scientific method, using accepted protocols of market observation, measurement, and evaluation of results.”

Let me elaborate the idea behind STS.

Scientific Trading System as model

A model is a logical framework intended to represent the financial markets reality.

So STS are a specific category of models that fulfill the necessary criteria (see above). One can use language to describe a model, yet the STS is the model and not the description of the model. Black-Scholes Model is a model of future fluctuations (volatility) of a security’s price. It’s a well-known option pricing model. It’s based on factors in current stock price, options strike price, time until expiration, and risk-free interest rates. These objects have associated properties (parameters). The model parameters determine how the theoretical value of European-style options change. This could be used to elaborate a further model (STS) to trade options. The last model can then be tested to see whether it accurately predicts future observations.

Keep reading because I’m about to explain how to design STS to achieve consistency.

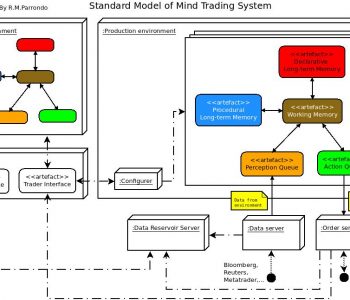

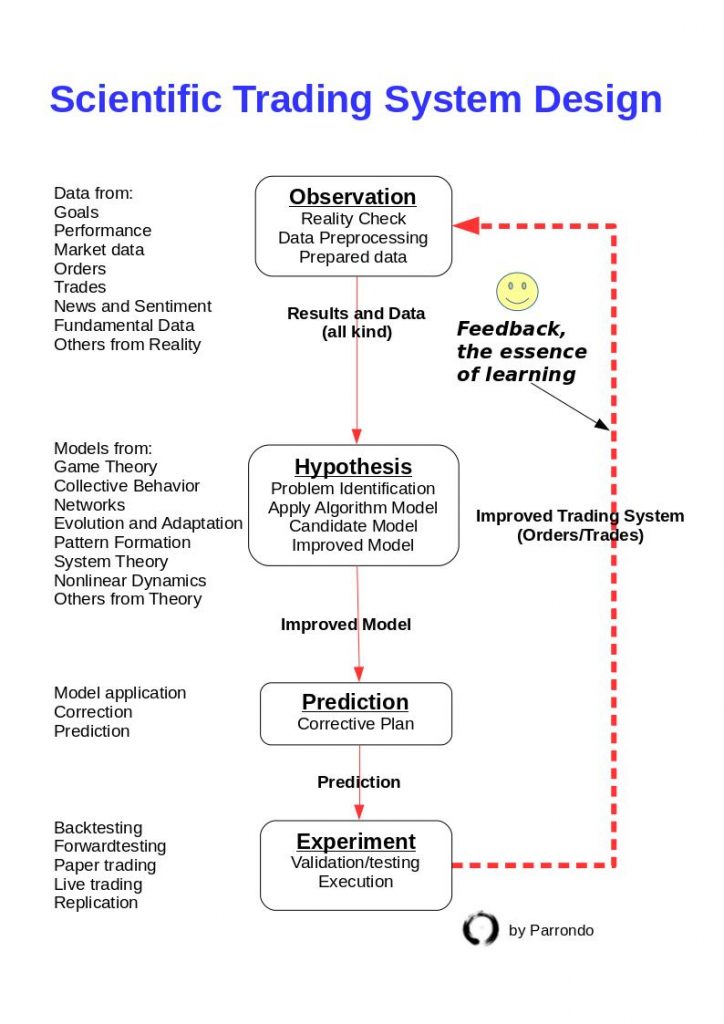

Scientific Trading System Design (STSD)

A quick search of Internet resources demonstrates that in reality there is no single uniform description of a trading system design. Some descriptions have four steps; others have six or eight. Some start with a market hypothesis; others start with market observation. Some emphasize one step of the process at the expense of the others. None of them establish a frontier between consistent and not consistent trading results. The following definition represents a fair and accurate definition of the design process. Their outcome is STS:

“The scientific trading system design is the process by which traders, individually or collectively and over time, try to construct STS”

Let us examine the statement in more detail:

- The Scientific Trading System Design is a process

- The STSDesign is used by traders

- The Scientific Trading System Design’s goal is to construct STS.

The process is not a cookbook recipe. That is to say, there is no owner’s manual or user’s guide. Many traders don’t even know the process details! …The loser ones.

The Process: Scientific Trading System Explained

In 2018, Quantopian (Obsolete) sponsored a new series of a trading contest with total prize money of 5000 USD/month (at the present time). The goal of the contest is to build a stock trading system. This should trade a significant time amount without trader intervention. Contest rules are hard. All these systems must earn money otherwise they will be disqualified.

Only the top ten earn prizes on a daily basis. More of the contestants do not win in first attempt. The contestants carefully monitored what happened in that contest, analyzed the data, and made corrections to their trading systems. Many contestants improve their positions in second attempt. Again, the contestants carefully monitored what happened in the contest, analyzed the data, and made corrections to their systems. Frequently contestants improve their positions in the third contest.

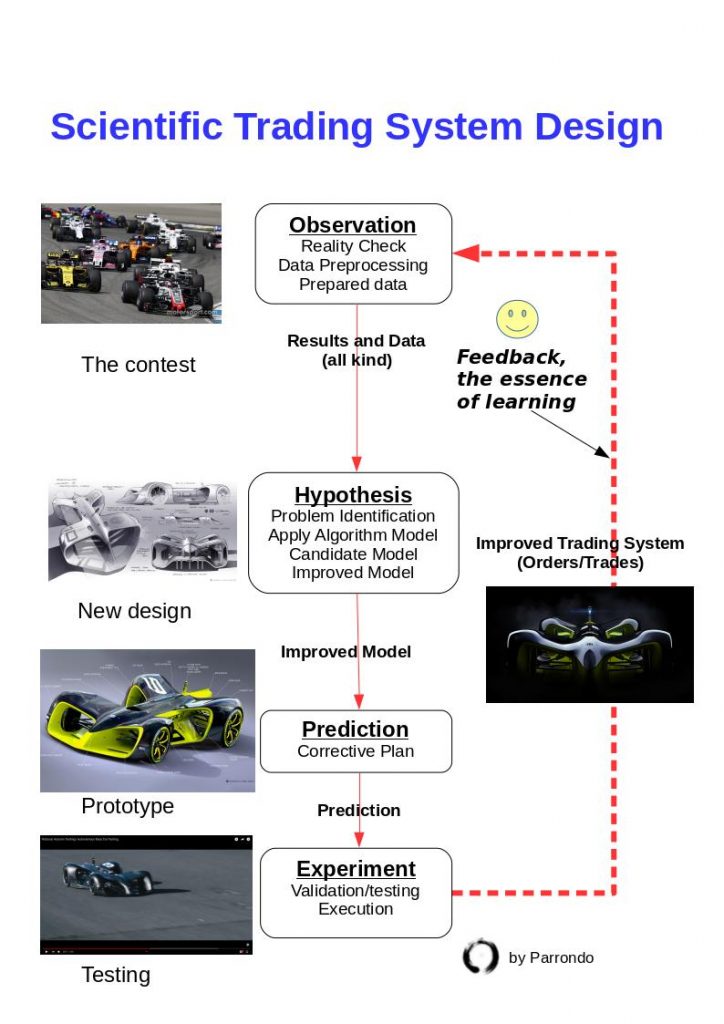

This is an example of the scientific trading system design in action. Notice the key elements of the process:

Observation

A trading reality check occurs (e.g. a contest with an undesirable result).

Hypothesis

Data is collected and analyzed based on (1).

Predictions

Improvements and corrections are made based on errors found in (2).

Experiment

Something better occurs next time (more desirable contest results) based on (3).

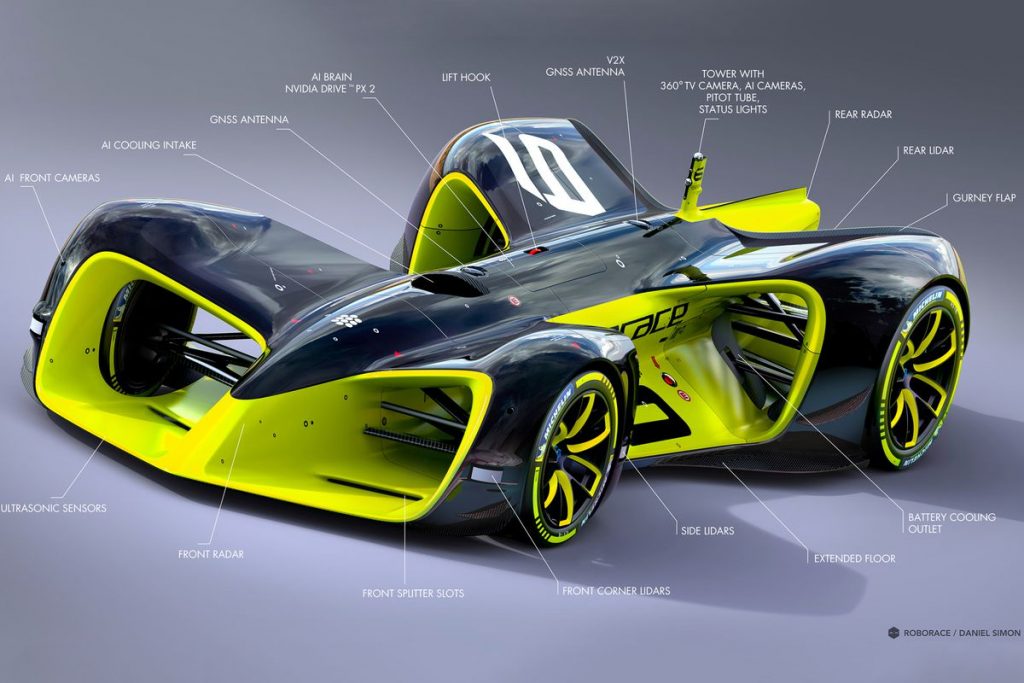

One could draw the process as follows:

What makes the process so effective is the “feedback loop” shown by the heavy red dot line. “Feedback” is a technical term for “learning.” Everybody do that: They make a mistake, figure out what they did wrong, and hopefully do not repeat the mistake. Each time a trader do that, she is using the scientific method! If she never learned, she would continue to make the same mistakes over and over entering into a loser loop. That is the power of the scientific method.

Some of the contestants didn’t finish any of the contests. Did they fail all the contests because they didn’t apply the scientific method? Not at all. They were wrong. They created errors in the process, and mistakes overwhelmed or camouflaged the truth, resulting in failure.

But, are traders scientists?

Keep reading and we’ll see.

The Traders

Most descriptions of the scientific method state that it is used by scientists. Many descriptions further restrict its use to “hard” science (physics, chemistry, and so on). Besides, other descriptions restrict its use to situations which involve physical magnitudes. Such statements are incorrect and false. Everybody learns; thus everyone uses the scientific method. Even learning machines!

“Learning” is essential to success, moreover for a trader success. For example, consider the situation of a compulsive gambler. Step 1 is to recognize the problem as a problem: “I cannot control my impulse to gamble

The Goal of Trading Systems Design

The goal of the scientific trading system design is to construct an accurate picture of financial market reality to determine when to buy and sell assets. We can define the Trading Truth as “the more accurate picture of financial market reality to best determine when to buy and sell assets” = Trading Truth (TT). So the goal of the STSD is to seek the Trading Truth. There is only one Trading Truth. TT is an entelechy and imply the perfect knowledge of future events.

I challenge you to apply the scientific method!

We will examine in more detail how the scientific method can be applied to discern the Trading Truth.

Some Sources of Error in Trading Systems

Below are the main sources of error that can arise when you design a scientific trading system

1) Observation to create the trading systems: In the contest

Failure to recognize and admit failure

An extreme example of this failure is the “everybody wins” syndrome. If a competitor does not recognize that not finishing the contest, or not finishing the contest earning enough to beat another competitor is a failure, that trader will not be motivated to learn and improve performance in the next contest. One would think that this is very rare, but the syndrome is wild in our trading world.

Failure to collect all the information needed

You need enough data to complete a thorough analysis, or to collect erroneous information for the analysis. Insufficient or erroneous information will result in erroneous conclusions and problem identification which exclude effective corrective action.

2) During hypothesis funding the trading systems

Incorrect assumptions

We can’t know everything and we can’t get full information. Thus we must make some assumptions about how things are, work, and so on. If these assumptions are wrong, they could result in wrong conclusions and results. A common mistake is to presume an outcome before complete the analysis and then use the analysis to support or justify the presumption. This is a fatal mistake that prevents all possibility of learning.

Sloppy, incomplete or incompetent analysis

These conditions will result in erroneous analytic results, usually identifying the wrong problem as the cause of failure. Again, since we can’t know everything, shortcomings in analytical approach and rigor result in identifying the wrong problem as the cause of failure. For example, assume that the contest failed because the trading system didn’t earn money. Why didn’t the trading system earn? It placed the wrong orders. Why did it place wrong orders? The order manager malfunctioned. Why? Etc. Sometimes we have to ask “Why?” dozens of times before we reach the root cause. The process is hard and very painful. So it requires extreme discipline to continue questioning, and many don’t. The incorrect diagnosis is one of the most common

Error and sensitivity analysis

One of the most critical, yet ignored, elements of this activity is error analysis, also known as a sensitivity analysis. This is very difficult. There is nothing perfect in this world; thus errors abound everywhere. One must identify both the sources of such errors and their possible e

On several month contests, we’ll have to face volatility variations. This could result in spreads greater than 25%; too much to succeed. How much error can we tolerate? How good an order manager can we actually design? But, the order manager accuracy may not matter if we can depend on a risk controller to recalculate the risk in contest. So, when an error analysis is not performed, we may be wasting a lot of energy, time, and resources trying to solve a problem that doesn’t exist!

3) In the predictions (corrective plan)

Bad problem identification

The success of the corrective action plan depends on how accurately the root cause problem was identified in the hypothesis step. What good is an improvement plan that does not address the real root cause of the problem? Why fix something that is not broken, and leave broken something that is broken? It’s the best recipe for disaster.

Assumptions and rigor

The success of the corrective plan depends on the same factors as the analysis of the problem: Accuracy of assumptions, rigor, completeness, and veracity of the planning process. What good is a corrective action plan that relies on uncontrollable factors?, “We failed because EUR/USD is raising and it won’t rise next time”? The same rigor and diligence are required in developing the corrective plan as was required for analysis. Make sure plan errors achieve acceptable tolerances – or failure will be a fact!

4) During the trading systems experiment

Exhaustive and honest tests

Improvements must be made honestly and thoroughly tested against the requirements of the corrective plan. For example, our corrective plan calls for a wheat-corn pair trading with frequent rebalances to control the risk. But, both markets have different liquidities and we could have to face the risk of losing one of the legs. If we don’t test the market volatility before entering the contest, the trading system will place incomplete orders and we will fail. If we do test it and find out the truth, we have an opportunity to take other corrective actions and still succeed. We know that few things work exactly as planned. So Exhaustive and honest testing is an essential element of success.

Stress and limit testing

The only certainty is that we will meet the unexpected. Therefore we need to conduct stress testing to see how the trading system will function under the usual adverse conditions. We are likely to encounter such as extreme volatility, important news, debt exposure and so on. Long-Term Capital lost $4 billion after a debt Management default by Russia. We need to validate that our trading system will work fine in the presence of high impact news like Fukushima disaster or Brexit. otherwise it will lost and fail the contest. The same logic applies to limit testing, which validates that the trading system will always work within the boundaries of its design limits.

The Worst Failure about Trading Systems

Lack of honesty and intellectual integrity: The foundation for the entire process is honesty, accuracy, and truthfulness for each step of the process. Lacking these human traits, the process is sure to fail because results, reports, and even tests will be falsified. But such falsification inevitably results in a

Conclusion

These concepts and design principles are all you need to build a formidable scientific trading system.

These systems are reliable, consistent and non-arbitrary.

Here you are the steps and the possible failure sources:

- Observation.

- Failure to recognize and admit failure

- Failure to collect all the information needed

- Hypothesis

- Incorrect assumptions

- Sloppy, incomplete or incompetent analysis

- Error and sensitivity analysis

- Predictions

- Bad problem identification

- Assumptions and rigor

- Experiment

- Exhaustive and honest tests

- Stress and limit testing

Apply yourself to these principles and in a few months you will have a consistent system and you could fight to be among the top ten of any contest.

Make sure to visit the site of Quantopian (Obsolete) and other interesting contests as Darwinex to test your scientific trading system design abilities.

In the next posts, I will show you how to implement these concepts and principles step by step.

Meanwhile do not forget to read my post about Social trading